Atlético Madrid continues growing and approved a major capital increase

Atlético HoldCo will have the shares of both leaders and will contribute 120 million soon. Ares Management also joins.

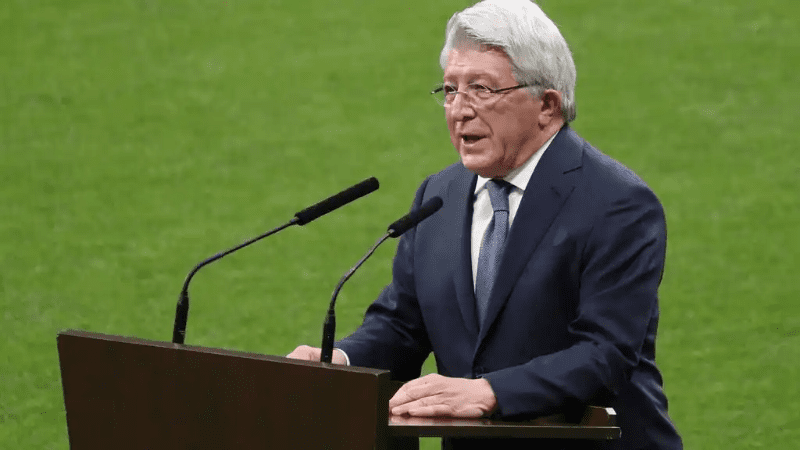

Atlético de Madrid has unanimously approved a capital increase of almost 182 million euros. The club has confirmed that, after the presence of 98.29% of the social mass, this change in the leadership has been given the green light. In this way, Atlético is now in the hands of a new company such as Atlético HoldCo, created by Enrique Cerezo and Gil Marín, and which will hold the majority of shares.

In addition, it adds a new investor such as Ares Management Corporation. "The General Board of Club Atlético de Madrid, SAD, meeting today at the Wanda Metropolitano stadium, with the attendance of partners representing 98.29% of the share capital, has unanimously agreed to a capital increase through the issuance of 972,082 new shares, with a nominal value of 8.5 euros and with an issue premium of 178.60 euros per share, representing a total of 181,876,542.20 euros, at a rate of 187.10 euros per share. action ", the club has notified, underlining that the current shareholders will have preferential subscription rights.

"To face this significant capital outlay," Atlético de Madrid announced, an agreement has been reached with Ares Management Corporation. A "strategic investor" that has acquired 33.96% of the shares owned by Atlético HoldCo, for which Mark Affolter, a partner of Ares, will join the Board of Directors of this new company.

This company is an alternative investment manager that Atlético defines as a "world leader" that provides "complementary primary and secondary investment solutions in the credit, private equity, real estate and infrastructure asset classes." In addition, according to the data provided, in 2021 they have 227,000 million dollars of assets under management.

More news

THE GANG IS HERE! First Argentine Stars Arrive in Buenos Aires for Final Qualifier Push!

01/09/2025

THE LAST DANCE! Lionel Messi Confirms His Final World Cup Qualifier in Argentina!

29/08/2025

TRANSFER COLLAPSES! Julio Enciso Fails Medical Exams, Returns to Brighton!

27/08/2025

Vini doesn't feel entirely comfortable at Real Madrid anymore and is seeking a future at another club

26/08/2025

HERE WE GO! Piero Hincapié Says YES to Arsenal, Club Prepares Final Bid for Leverkusen Star!

26/08/2025

THE REAL MADRID SHOWDOWN: Nico Paz's Future Sparks a Bidding War Across Europe!

25/08/2025

SOUTH AMERICAN SHAME: Independiente vs. U. de Chile Match Canceled After Horrific Incidents!

21/08/2025

Rodrygo Benched by Xabi Alonso: The End of an Era at Real Madrid?

20/08/2025

PARIS IN PARIS! The New Superclub, Paris FC, Rises to Threaten PSG-Marseille Rivalry!

20/08/2025

PSG’s €850M Budget is 30x Larger Than the Smallest in Ligue 1!

19/08/2025

THE DEBUTS ARE HERE! Estupiñán & Modrić Step Onto the San Siro Stage!

18/08/2025

CONTROVERSY IGNITES! Barcelona Opens Season with a Contested 2-0 Victory Over Mallorca!

18/08/2025

SCANDAL ESCALATES: Donnarumma's Harsh Letter Responds to Luis Enrique's Super Cup Snub!

15/08/2025

Franco Mastantuono: A New Number 30 for Real Madrid with a Nod to the Past

14/08/2025

HISTORY MADE! PSG Wins First-Ever Super Cup Title in Thrilling Penalty Shootout!

14/08/2025

Mastantuono Arrives at Valdebebas for Real Madrid Presentation

13/08/2025

ON AND OFF THE PITCH: Is Nicki Nicole the New WAG of Barcelona's Lamine Yamal?

13/08/2025

Donnarumma Bids Farewell to Paris Saint-Germain at the Peak of His Career

13/08/2025